In September 2022, Union Finance Minister Nirmala Sitharaman called on India Inc at an industry summit to put money into expanding their capacities, asking “what’s stopping you” from investing. That quarter, India’s real GDP growth rate more than halved to 6.3% — now revised to 6% — after the post-Covid favourable base effect continued to fade away.

Three years later, the GDP has grown by 8.2% in the same three-month period. And yet, a big question mark remains over the state of investments by the private sector. This is not a recent problem, according to Jahangir Aziz, JP Morgan’s Head of Emerging Markets Economic Research.

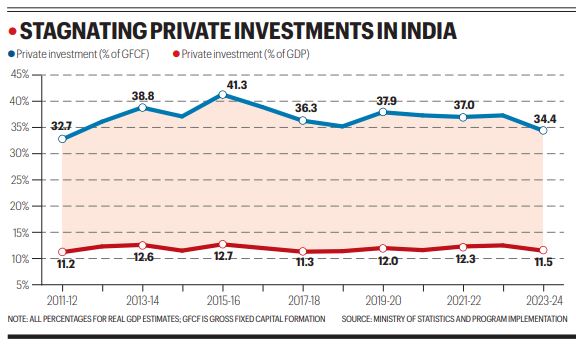

“Since 2011-12, private corporate investment has flatlined at around 12% of GDP. There are small quarterly variations, but it has not broken out of the 12% of GDP range. Over these 15 years, you’ve had numerous global and local shocks. The only thing that has remained constant is private investment in 12% of GDP range,” Aziz told The Indian Express earlier this month.

Mixed signals

It’s not just that private capital expenditure has been stuck at around 12% of GDP for more than a decade. Of the total investments in the country, or Gross Fixed Capital Formation (GFCF), private capex’s share declined to 34.4% in 2023-24 — the lowest since 32.7% in 2011-12. As a percentage of GDP, while GFCF as a whole has risen from under 31% in 2016-17, at 33.7% in 2024-25 it was still lower than the 34%-plus figures seen at the start of the last decade.

Despite the stagnant picture painted by these numbers, why are green shoots constantly seen in private capex? The answer lies in the absence of an all-encompassing, irrefutable data.

Stagnating private investment in India

Stagnating private investment in India

According to CareEdge Ratings, the total capex of nearly 2,000 listed non-financial companies rose 11% in 2024-25 to Rs 9.4 trillion, after adjusting for overseas investments and acquisitions. Meanwhile, Bank of Baroda economists say that balance sheets of more than 4,500 companies show that total gross fixed assets were up 8.5% year-on-year as at the end of September 2025.

At the same time, the Statistics Ministry’s new private capex survey shows investment intentions for 2025-26 amounted to Rs 4.89 lakh crore, down 26% from 2024-25. But the survey has too many caveats to be taken at face value. It covered only large enterprises, with 29% of those surveyed not reporting any capex intentions for this fiscal due to various reasons, including pending approvals.

Story continues below this ad

Another frequently used measure of private capex is project announcements. According to investment monitoring firm Projects Today, the private sector’s share in fresh projects in the first half of 2025-26 rose to 70.8% from 61.3% in the previous six months as their new investment plans rose 41% to Rs 24 lakh crore. But not all announcements result in actual investment.

Then there is the informal sector, for which capex data is even more difficult to pinpoint. But the Statistics Ministry’s Annual Survey of Unincorporated Enterprises tells us that the fixed assets owned by each enterprise rose just 1.9% in the 12 months ending September 2024.

Capacity expansion

If the overall picture is somewhat muddied, the following should offer some clarity. A study published this month by R Kavita Rao and Suranjali Tandon of New Delhi-based think-tank National Institute of Public Finance and Policy said data suggests that while the corporate tax cut of September 2019 increased companies’ surplus, the money was not invested in plant, machinery and other physical assets.

“In the case of BSE 500 companies there is an increase in the share of financial (long term and short assets) investments in total assets over the last decade, more so after 2023. In fact, in 2025 a quarter of the assets were financial investments for these companies,” the study said.

Story continues below this ad

Not only have companies chosen to sit on cash or invest financially, they have also sought to cut down their debt.

According to Bank of Baroda economists, the interest coverage ratio of more than 3,000 companies — excluding those from the financial sector — has more than doubled to 5.97 in the first half of 2025-26 from 2.6 in the same period of 2020-21. The higher the interest coverage ratio, the better the financial health of a company.

So why isn’t the private sector investing in more production capacity? Because they don’t see the need to, as current facilities are more than sufficient to meet demand.

According to a RBI survey, capacity utilisation in manufacturing sector has struggled to break past 75% — widely seen as the level that must be crossed on a sustained basis for firms to invest. In the 53 quarters since the start of 2012-13, capacity utilisation has exceeded 75% on just 10 occasions.

Story continues below this ad

In its most recent manufacturing survey for October-December 2024, the Federation of Indian Chambers of Commerce & Industry noted several challenges to private sector investments. These included rising raw material costs, high interest rates, expectations of weak domestic and export demand, lengthy approval processes, non-tariff barriers, limited access to advanced machinery, high land prices and competitive pressures from countries benefiting from trade advantages. While interest rates have fallen over the course of 2025, other challenges remain.

Stagnating private investment in India

Stagnating private investment in India