Breaking their silence on a Sebi-stipulated deadline of March 31, 2020, for the top 500 listed companies to separate the post of Chairman and Managing Director/ Chief Executive Officer, and ensure the two are not related, top industrialists Rahul Bajaj and Venu Srinivasan have said that India’s joint family system distinguished it from European businesses — and Western concepts should not be imported blindly.

“I am completely against it for Indian conditions where other than foreign companies and PSUs, even the top 200 companies in the private sector have over 90 per cent identified owners, who either manage or control the companies,” Rahul Bajaj, Chairman, Bajaj Auto Ltd, told The Indian Express. Rahul Bajaj’s son Rajiv Bajaj is the Managing Director of the company.

Venu Srinivasan, Chairman and Managing Director, TVS Motors Ltd, said, “In the US, power gets too concentrated when the same person, with insignificant holding, becomes the Chairman and CEO of a company. But in India and Asia, in general, families own significant holding in companies. They are committed to create wealth. You cannot import Western rules in an unrelated system.” The family has 40-70 per cent shareholding across group companies.

On May 9, 2018, Sebi amended the ‘Listing Obligations and Disclosure Requirement’ regulations stating that the Chairperson of the board shall be a non-executive director and not related to the MD/ CEO. This, however, does not apply to listed entities, which do not have any identifiable promoters as per their shareholding pattern.

The regulator’s amendments followed the October 2017 recommendations of the Committee on Corporate Governance chaired by Uday Kotak, which observed the time was right to introduce the separation of roles of Chairperson and MD/ CEO of listed entities. In framing the regulations, Sebi went a step ahead and said the two persons should not be related either.

The issue assumes significance given the sharp powering down of the economy with much of India Inc feeling the pressure of revenues due to slowing demand, a squeezing of the bottom line due to huge interest burden on debt, and over-capacity due to under-utilised assets. To top it all, businessmen or promoters are fighting to retain ownership of their companies with creditors pushing them to the IBC, and forcing bankruptcy or liquidation.

In this scenario, leading industry associations Confederation of Indian Industry (CII) and Federation of Indian Chambers of Commerce and Industry (Ficci) view this move as a needless reform at the wrong time. With less than five months left for the deadline, Ficci has formally written to Finance and Corporate Affairs Minister Nirmala Sitharaman and sought a review.

Story continues below this ad

In its letter, Ficci said 90 per cent of business in India is controlled by families. “Mere restriction on having related persons as Chairperson and MD/ CEO is inadequate to ensure effective Board leadership and this decision should be left to the shareholders to decide,” Ficci President Sandip Somany, who is also the Chairman and Managing Director of HSIL Ltd, one of the listed companies affected by the Sebi norm, wrote in a letter dated October 9.

The CII, too, has written to the government. A senior CII functionary said that a company board was best placed to take a call based on the nature of the business and competition profile of the sector in which it operated. “The CII has pointed out that the Companies Act, 2013, itself has left it to the shareholders to decide,” he said.

Section 203 of the Companies Act requires all companies to have a separate Chairperson and MD/ CEO unless the Articles of Association of the company provides otherwise. In other words, it lets the shareholders take a call on the issue.

So far, the action taken by the top 500 listed companies has been mixed. According to information collated for The Indian Express by Prime Database, a research firm that tracks capital markets, the Chairperson and the MD/ CEO are the same in 159 of the top 500 listed companies by market capitalisation. Further, 215 of these companies have an Executive Chairperson, whereas Sebi requires the Chairperson to be a non-executive director.

Story continues below this ad

“If an owner holds significant percentage of equity in a company and is not allowed to pass on the reins to his family member, who will he hand over the reins to? I can only hope that the government will at least defer the implementation of this regulation, if not withdraw it,” Bajaj said.

The Ficci letter said: “India’s large-sized corporate business houses like Tatas, Ambanis, Birlas, Godrej, Wadias, Munjals, Mahindra, Mittals, Shapoorji Pallonji, Jindals, Adanis, Anil Agarwal of Vedanta, Bajajs, Bennett Coleman, and many more are managed by family members. The role of family and the family patriarch is quite important in the Indian ethos… most Indian family businesses have been generating stronger top-line growth than their non-family peers.”

Globally, though, regulators in developed countries do not encourage this practice, and shareholders do not take to it kindly either. Germany does not allow it. The separation of Chairperson and CEO is not mandatory in the UK, but markets disapprove of it. In the US, shareholders are increasingly exerting pressure on companies to split the Chairman and CEO posts. Since 2001, the number of companies in S&P 500 with the same person being the Chairman and the CEO has more than halved to about 45 per cent.

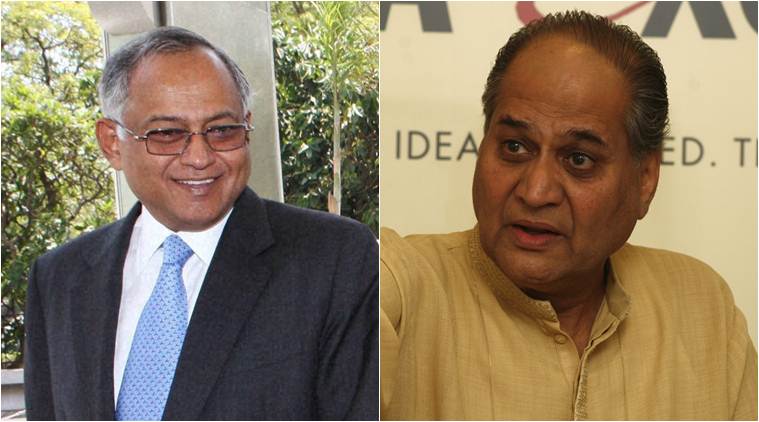

Against it: Rahul Bajaj; can’t import blindly from West: Venu Srinivasan

Against it: Rahul Bajaj; can’t import blindly from West: Venu Srinivasan