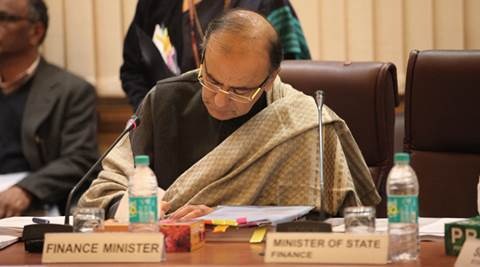

At the launch of the Start-Up India campaign, Finance Minister Arun Jaitley had held out the promise of a friendly tax regime, especially for start-ups. It is a commitment this government made after being voted into office, in the context of widespread criticism of the retrospective taxation measures introduced in the second half of the UPA’s tenure. Now, the government has the first report of an expert committee headed by Justice R.V. Easwar, mandated to help bring more predictability in tax laws and to simplify tax laws. The committee has recommended raising the threshold for Tax Deducted at Source (TDS) and reduction of TDS rates from 10 per cent to 5 per cent for individuals and Hindu Undivided Families, amending the capital gains tax laws to provide relief to retail investors who get caught in demands made by taxmen and simplification of the distinction between capital gains and business income, changes in law to avoid delay in the issue of tax refunds, a presumptive income scheme for professionals as part of the move to ensure ease of business, and encouragement of electronic filing and measures to reduce the compliance burden.

Much of these appear to be aimed at mitigating the concerns of smaller taxpayers and the growing band of professionals — a constituency the government appears keen to tap. With close to 65 per cent of personal income tax collections accounted through TDS, any move to make it more taxpayer-friendly ought to be welcomed. Similarly, given the long history of litigation between the income tax department and taxpayers on whether investment in shares or securities is business income or investment income, the latest recommendation on a threshold of Rs 5 lakh makes sense. But that may not necessarily be the case with the suggestion to kick off a presumptive scheme for professionals — if only because of past experience with such schemes, especially for small businessmen.