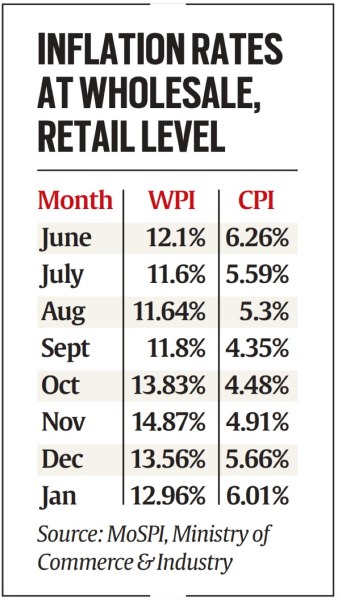

Inflation at the wholesale level in January softened to 12.96 per cent from 13.56 per cent a month ago but marked the tenth consecutive month of being in double digits. Wholesale food inflation was at a 24-month high of 9.6 per cent, data released on Monday showed.

Why is the fresh surge in inflation a concern?

The high retail inflation is now seen turning structural, with price rise in non-food segments such as clothing, fuel and light, household goods, health, transport, and communication being seen above 6 per cent. Most states have witnessed higher than 6 per cent inflation with Haryana registering the highest inflation of 7.2 per cent.

The structural aspect of inflation is reflected in the core inflation remaining sticky (5.96 per cent in January). Clothing & footwear inflation now stands at a 97-month high (8.84 per cent) on the back of higher cotton prices. Household goods and services inflation at 7.1 per cent is at a 94-month high in January. Amid elevated input costs, various automobile, telecom and FMCG firms have announced price hikes.

Why the worry

As RBI keeps its monetary stance easy to ensure a broad-based recovery, there are risks of retail inflation becoming more generalised. There are already signs of inflation turning structural in non-food segments like clothing, health and transport. High global inflation and rising crude oil prices will exert further pressure.

Wholesale Price Index (WPI)-based inflation rate, which is in double digits, is reflective of the price pressures on the inputs side and of manufacturers passing on the higher input costs to their output prices. High global inflation and rising crude oil prices will exert further pressure.

Going ahead, the CPI inflation is expected to peak in the ongoing quarter and may not moderate as quickly as projected, especially if domestic demand rebounds after the abatement of the less severe third wave, economists said but ruled out an immediate change in stance by the RBI.

How does RBI view high inflation?

Before the government released data on inflation on Monday, RBI Governor Shaktikanta Das said there was no need to panic on the inflation front. “Today’s inflation print is expected to be around 6 per cent. So that should not surprise or create any alarm, because we have taken that into consideration,” he said after the RBI board’s customary post-Budget meeting with Finance Minister Nirmala Sitharaman.

Story continues below this ad

There was a delicate balance between inflation and growth and the Reserve Bank was fully aware of its commitment to inflation, Das said. The momentum of inflation in India, he pointed out, has been moving down since October and that the “price stability” was of foremost importance to the central bank. “The rise in CPI inflation during October-December is mainly on account of the statistical effect of a low base,” he said.

Last week, the RBI had projected India’s average inflation to soften to 4.5 per cent in 2022-23, down from an estimated 5.3 per cent in 2021-22. The RBI’s inflation projections are “robust” but contingent on downside and upside risks associated with the movement of global crude oil prices, he said. “At this point of time, our inflation projections are quite robust, and we stand by it. If there is something of course totally unforeseen, which nobody can expect, (then) that is different…,” he said.

With respect to rising oil prices and their impact on inflation, he said the RBI considers a particular range within which crude prices are expected to fluctuate considering all the factors that can be anticipated and sort of foreseen as of today.

In its monetary policy review on February 10, RBI kept the key policy rates unchanged and maintained an accommodative stance. It also took note of the cost-push pressures on core inflation – the non-food, non-fuel component of inflation. “Going forward, vegetable prices are expected to ease further on fresh winter crop arrivals. The softening in pulses and edible oil prices is likely to continue in response to strong supply-side interventions by the Government and increase in domestic production. Prospects of a good Rabi harvest add to the optimism on the food price front. Adverse base effect, however, is likely to prevent a substantial easing of food inflation in January,” it said.

Story continues below this ad

The RBI has projected 5.3 per cent retail inflation for FY22, with Q4 inflation seen at 5.7 per cent before easing to 4.9 per cent in Q1 FY23.

Newsletter | Click to get the day’s best explainers in your inbox