For April-December 2017-18, the states earned Rs 1.50 lakh crore from taxes and duties on crude and petroleum products, official data showed. Express photo by Partha Paul.

For April-December 2017-18, the states earned Rs 1.50 lakh crore from taxes and duties on crude and petroleum products, official data showed. Express photo by Partha Paul.

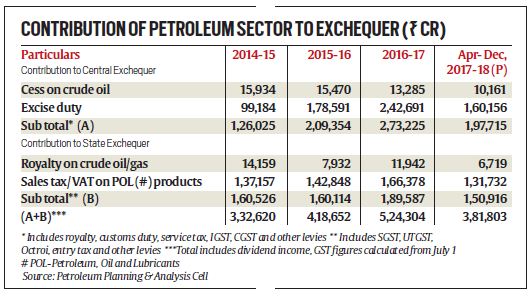

As the debate continues about reduction in taxes on fuel amid the surging prices, a closer look at the government data reveals that the Centre’s mop up from taxes and duties on crude oil and petroleum products more than doubled to Rs 2.73 lakh crore in 2016-17 and rose about 57 per cent to Rs 1.97 lakh crore in April-December 2017-18 from Rs 1.26 lakh crore collected in 2014-15.

The contribution of taxes and duties on crude and petroleum products for states rose 18.1 per cent to Rs 1.89 lakh crore in 2016-17 from Rs 1.60 lakh crore collected in 2014-15.

For April-December 2017-18, the states earned Rs 1.50 lakh crore from taxes and duties on crude and petroleum products, official data showed.

The Centre mopped up Rs 2.42 lakh crore from excise duty on petroleum products in 2016-17 and Rs 1.60 lakh crore in April-December 2017-18. States’ earnings through sales tax or Value Added Tax on petroleum products increased to Rs 1.66 lakh crore in 2017-18 . The collections in April-December, the first nine months of 2017-18, at Rs 1.31 lakh crore were, however, slightly lower than Rs 1.37 lakh crore in 2014-15. Data for full financial year of 2017-18 is not available.

The Centre has raised excise duty nine times between November 2014 and January 2016 to shore up finances as global oil prices fell. If one adds the dividend income, dividend distribution tax, corporate/income tax and profit petroleum on exploration of oil and gas, the Centre’s total earnings from crude and petroleum products stood at Rs 2.30 lakh crore in April-December 2017-18 and Rs 3.34 lakh crore in 2016-17. In 2014-15, total contribution to central exchequer from crude and petroleum products had stood at Rs 1.72 lakh crore.

Adding the dividend income to state governments, the earnings from crude and petroleum products rose to Rs 1.89 lakh crore in 2016-17 from Rs 1.60 lakh crore in 2014-15. For 2017-18 (April-December), the total contribution to state exchequer from crude and petroleum products stood at Rs 1.50 lakh crore.

A look at the detailed break-up of state-wise earnings from sales tax/VAT on petroleum products shows that Maharashtra earned the highest in April-December 2017-18 with collections of Rs 19,053 crore, followed by Uttar Pradesh with mop-up of Rs 12,421 crore.

Story continues below this ad

Crude petroleum attracts nil customs duty, 20 per cent oil industry development cess and Rs 50 per metric tonne as National Calamity Contingent Duty (NCCD). A customs duty of 2.5 per cent is levied on petrol and diesel, while the excise duty is levied at Rs 19.48 a litre for petrol and Rs 15.33 a litre for diesel. State sales tax or VAT varies from state to state. Unlike excise duty, VAT is ad valorem and results in higher revenues for the state when rates move up. The government raised excise duty nine times between November 2014 and January 2016 to shore up finances as global oil prices fell. It cut excise duty just once by Rs 2 per litre in October last year.

While products such as LPG, kerosene, naphtha, furnace oil, light diesel oil attract levy of Goods and Services Tax (GST), five petroleum products — crude oil, diesel, petrol, natural gas, aviation turbine fuel (ATF) — still out of the GST ambit. Petroleum ministry and Civil Aviation Ministry have approached Finance Ministry for the inclusion of petrol, diesel and Aviation Turbine Fuel, respectively, under GST. Though the ministry is yet to formalise a view, natural gas and ATF are likely to be among the first entrants under the indirect tax regime, contingent to approval by the GST Council.

For April-December 2017-18, the states earned Rs 1.50 lakh crore from taxes and duties on crude and petroleum products, official data showed. Express photo by Partha Paul.

For April-December 2017-18, the states earned Rs 1.50 lakh crore from taxes and duties on crude and petroleum products, official data showed. Express photo by Partha Paul.