Express Clinic

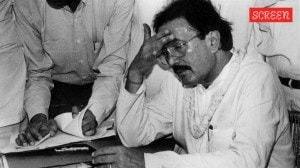

Himanshu Kalra works with an Infrastructure company. He stays with his wife Shruti in delhi. During the start of his career he availed of credit cards for his lifestyle expenses

Name: Himanshu Kalra

Resides in: Delhi

Profession: Sr Manager,Marketing

Net annual income

Rs 6,00,000

Status amp; goals

Himanshu Kalra 30 works with an Infrastructure company. He stays with his wife Shruti 28 in delhi. During the start of his career he availed of credit cards for his lifestyle expenses,which have piled up to huge debt now. He is planning a child In the next few years which has increased his concerns about the future. With fewer savings at present and increasing responsibilities,he wants to have a debt free life so that he can plan for his life goals

Needed

A roadmap which can guide him to manage his debt and create a secure financial future

Net monthly surplus

Rs 5,000

Current Investment

PPF: Rs 50,000

EPF: Rs 60,000 FDs: Rs 1,00,000

Equity MF: Rs 80,000

Gold: Rs 1,00,000

Cash: Rs 20,000

Insurance Surrender Value: Nil

Findings

Emergency fund

Himanshu is maintaining R 20,000 in his savings account

Health Insurance

Covered for self and wife for R 3 lakh through his employer

Life Insurance

Covered for Rs 1 lakh through a traditional policy and paying a premium of R 8,000 annually.

Investment decisions

Takes all investment decisions himself

Liabilities

Credit card outstanding of R 3 lakh

Recommendations

Credit Card Repayment

Himanshu should utilise fixed deposits,balance in savings account and gold to repay his credit card outstanding immediately. For meeting the shortfall either he can borrow from his family/ relatives or he should reduce unwanted expenses to clear his credit card dues in next few months.

Express Tip: Buying on credit is always a costly affair because you repay from your future income.

Emergency Fund

Creation of an emergency fund of R 3 lakh is recommended through monthly savings. Any surplus received from employment should be allocated for this goal.

Express Tip: Emergency fund caters to any unplanned expenses,the ones that pop up with no warning such as unexpected bills,deaths,job loss,illness,unexpected life circumstances and appliance repairs/replacements.

Life Insurance

Himanshu8217;s insurance need is R 87lakh. This can be met through a term plan for which he will have to pay R 18,300 p.a.

Express Tip: Insurance need changes with increase in liabilities. Cover should be periodically reviewed and enhanced when required.

Health Insurance

Himanshu should buy a standalone health insurance of R 5 lakh for his family.This will cost him R 6,300 annually.

Express Tip: If not planned,the high cost of medical treatment can drag you few years behind if any emergency arises in future.

Vacation

Himanshu will have to defer this goal till his existing liabilities are repaid and planning for long term goals have been achieved.

Express Tip: When your finances are in trouble,the top priority should be to avoid expenses which are for entertainment and do not appreciate in value.

Buying a Car

He should defer this goal for two years and aim for a low budget car. By investing R 3,500 pm in monthly income plans from mutual funds,he will accumulate a corpus of R 2 lakh for the car purchase.

Return assumed-9 p.a.

Express Tip: Car purchase is a lifestyle expense. More than luxury,affordability and efficiency should be the primary criteria.

Retirement Planning

Himanshu will receive Rs two crore from his EPF if continued till retirement. For balance corpus,monthly investment of Rs 6,500 in diversified equity mutual funds is recommended. Alternatively,he should look at reducing his lifestyle expenses which are high with respect to his current income.

Return assumed: 12 p.a.

Express Tips: Starting early for your long term goals helps in minimising the required savings and prepares you for accommodating life changes which can impact you financially.

- 01

- 02

- 03

- 04

- 05