Stay updated with the latest - Click here to follow us on Instagram

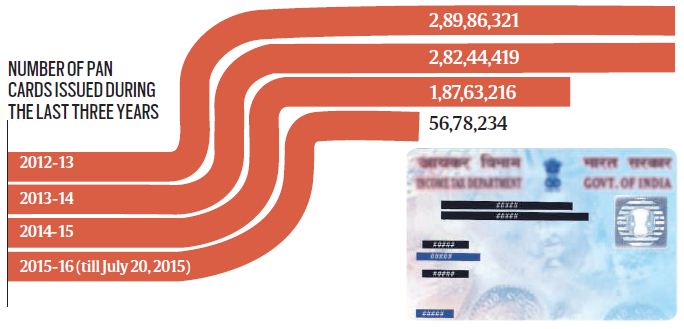

PAN Cards: Tracking transactions

PAN cards are currently issued through both manual as well as online applications.

As the finance ministry tries to improve tax compliance, the 10-digit alphanumeric Permanent Account Number (PAN) is a key tool that the tax man uses to track transactions. To stem the flow of domestic black money the Finance Act, 2015, has made it mandatory to quote PAN for all cash purchases or sale exceeding Rs1 lakh.

PAN cards are currently issued through both manual as well as online applications.

Both procedures are executed through Service Providers namely National Securities Depository Limited (NSDL) and UTI Infrastructure Technology and Services Limited (UTIITSL).

PAN is required for a number of transactions including filing of income tax returns, sale or purchase of any immovable property beyond a certain amount and sale or purchase of a motor vehicle.