Explained: What fewer people filing income tax returns in the pandemic year suggests

Tax experts see the contraction as an indication of a shrinking of the segment, as well as possible delayed return filings due to the various extensions provided to taxpayers amid the pandemic.

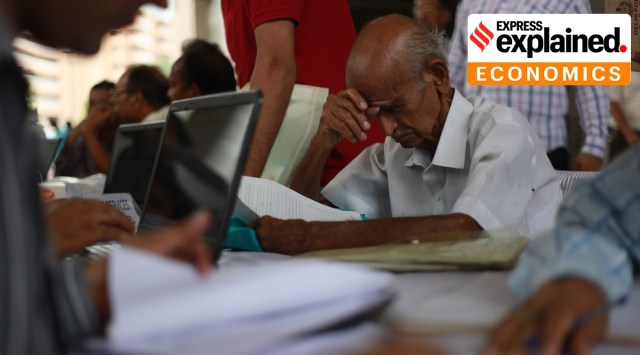

People file their income tax returns at the Civic Centre in New Delhi. (Express Photo: Tashi Tobgyal, File)

People file their income tax returns at the Civic Centre in New Delhi. (Express Photo: Tashi Tobgyal, File)India’s economic stress preceded the Covid-19 pandemic, but worsened in its aftermath as individuals with incomes and salaries took a hit. The latest government data shows a 6.6 per cent contraction in the number of income tax returns (ITRs) filed by individuals earning up to Rs 50 lakh in financial year 2019-20.

Newsletter | Click to get the day’s best explainers in your inbox

Income Tax Returns filed

The latest data on ITRs showed a 9.8 per cent contraction in filings of ITR-1 offline and 4.5 per cent contraction in filings of ITR-1 online for FY20.

ITR-1 Sahaj can be filed by a resident individual, who is not included in the Hindu Undivided Family (HUF), having an income of up to Rs 50 lakh. Total income includes income from salary or pension, income from one house property, income from other sources such as interest from a bank account (excluding winnings from lottery and income from racehorses, income taxable under section 115BBDA, or income of nature referred to in section 115BBE) and where agricultural income is up to Rs 5,000.

High-income earners

The ITRs filed by high-income earners also showed a decline. A 3.5 per cent decline was recorded in FY20 for the filings of ITR-2, which is filed by individuals and HUFs having an income of more than Rs 50 lakh.

An individual having income from salaries, more than one house property, capital gains and income from other sources, having income from sources outside India and holding assets outside India can file ITR-2, though the income should not be from profits and gains of business or profession.

Trend

The overall filings of ITRs including individuals, corporates and businesses shrank 6.5 per cent in FY20. The filings of ITR-3, which is filed by an individual and HUF whose income is from business or profession, or an individual holding partnership in a firm, contracted 18.3 per cent in FY20.

Tax experts see the contraction as an indication of a shrinking of the segment, as well as possible delayed return filings due to the various extensions provided to taxpayers amid the Covid-19 pandemic. January 10 was the deadline for taxpayers to file returns for FY20, while those with audits had a deadline of February 15. Data for the full year is likely to reflect more details regarding payment of taxes and delayed return filings, while the full impact of Covid-19 pandemic will be visible in the coming year in the filings of ITRs for FY21.

- 01

- 02

- 03

- 04

- 05