Less than 4% market share, 40% fleet grounded: Can SpiceJet avoid a crash landing?

SpiceJet is operating with a market share below 4%, a 40% fleet grounding, and a 35% YoY revenue decline in Q3FY25. Despite these setbacks, it has raised Rs 3,000 crore in funding, with promoters injecting an additional Rs 294 crore. But is this enough? Is SpiceJet preparing for a second comeback, or is it running out of altitude?

In the November 2024 tender, the civic body notified that it was looking to pick an agency for setting up a 50 tonne per day (TPD) Material Recovery Facility (MRF) for the management of dry solid waste in Dwarka’s Sector-29 of the Najafgarh zone under the MCD jurisdiction, on a public private partnership (PPP) basis, along with managing an existing MRF plant of 5 tonnes per day.. (Express Archive Photo by Praveen Khanna)

In the November 2024 tender, the civic body notified that it was looking to pick an agency for setting up a 50 tonne per day (TPD) Material Recovery Facility (MRF) for the management of dry solid waste in Dwarka’s Sector-29 of the Najafgarh zone under the MCD jurisdiction, on a public private partnership (PPP) basis, along with managing an existing MRF plant of 5 tonnes per day.. (Express Archive Photo by Praveen Khanna)In 2014, SpiceJet was on the brink of collapse.

A cash crunch, grounded planes, and unpaid dues almost pushed the airline out of the skies. But against the odds, it pulled off a turnaround. Fast forward to 2025, and the turbulence isn’t over — SpiceJet is now operating with less than 4% market share, a 40% fleet grounding, and a 35% YoY revenue decline in Q3FY25.

Meanwhile, IndiGo controls a dominant ~62% market share, and Tata Group’s airlines hold 25%, leaving SpiceJet gasping for space in an industry where scale is everything.

Despite these challenges, SpiceJet is still in the air. In September 2024, it raised Rs 3,000 crore in funding, with promoters injecting an additional Rs 294 crore in March this year. But will this be enough?

Is SpiceJet gearing up for a second comeback, or is it running out of altitude? Let’s break down its financial health, competitive pressures, and whether investors should buckle up — or bail out.

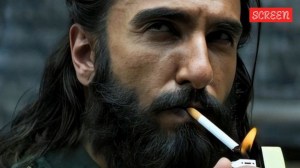

SpiceJet Ltd Share Price Chart (Apr ‘15 till Apr ‘25)

Stock price movement of SpiceJet Ltd. (Source: Screener.in)

Stock price movement of SpiceJet Ltd. (Source: Screener.in)

SpiceJet’s business model: Lean, low-cost, and under pressure

SpiceJet operates as a low-cost carrier (LCC), a business model that prioritises low operating costs, high fleet utilisation, and minimal frills to keep ticket prices competitive. The fundamental principle behind an LCC is to maximise revenue per aircraft through frequent flights and high passenger loads while keeping expenses like maintenance, airport charges, and crew costs under control.

This model has been successfully executed by IndiGo and other global players such as Ryanair and Southwest Airlines, but in India’s aviation market, the ability to maintain cost efficiency while expanding operations has proven challenging for SpiceJet due to financial stress, fleet unavailability, and competition from larger airlines.

1. Declining domestic passenger traffic and capacity utilisation

One of the biggest challenges for SpiceJet has been the consistent decline in domestic passenger traffic and flight capacity.

In 2023, the airline carried 8.39 million passengers domestically, covering 8.6 billion passenger kilometres. However, in 2024, these numbers dropped to 6 million passengers and 5.89 billion passenger kilometres, representing a 28% and a 31.5% decline, respectively.

| Year | Total Domestic Passengers Carried | Passenger KMs Performed |

| 2023 | 8,390,024 | 8,604,764,000 |

| 2024 | 6,008,185 | 5,893,272,700 |

| Change | -28.4% | -31.5% |

This decline reflects a combination of fleet grounding, limited route expansion, and competitive pressure from IndiGo and Tata Group airlines.

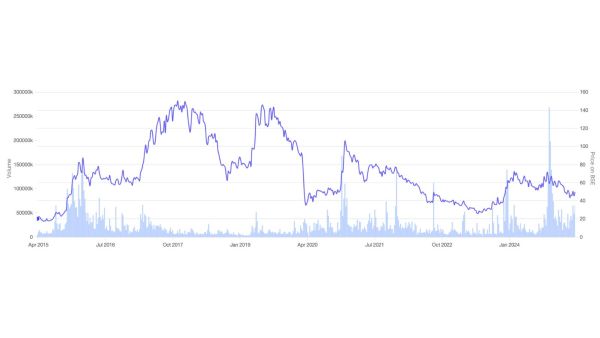

Number of operational aircraft. (Source: SpiceJet Quarterly Report Dec 24)

Number of operational aircraft. (Source: SpiceJet Quarterly Report Dec 24)

Furthermore, passenger load factors, which measure how efficiently seats are filled, have fluctuated. While a load factor of above 80% suggests strong demand, the inability to increase ASKM (Available Seat Kilometers) means SpiceJet cannot fully capitalise on its pricing strategies.

2. International passenger decline and market share pressure

SpiceJet has historically positioned itself as a regional international airline, serving nearby destinations in the Middle East and Southeast Asia. However, like its domestic operations, its international segment has struggled with declining passenger numbers.

| Year | Total International Passengers Carried | Passenger KMs Performed |

| 2023 | 1,821,513 | 4,124,986,000 |

| 2024 | 1,610,367 | 3,844,577,000 |

| Change | -11.6% | -6.8% |

While the 11.6% drop in international passengers is lower than the domestic decline, the 6.8% reduction in distance travelled suggests a shift towards shorter international routes or reduced flight frequency on longer routes.

Several factors contribute to this trend:

- Competitive pressure from Air India and Vistara: The Tata Group’s consolidation of Air India, Vistara, and AirAsia India has created a stronger full-service offering, attracting more international travellers who prefer comfort and connectivity.

- Operational constraints: With limited aircraft availability, SpiceJet has had to scale back on high-yield routes, making it difficult to compete with carriers that have stable fleet utilisation.

- Market dynamics: IndiGo has expanded aggressively into international markets with long-haul narrowbody aircraft, taking market share from smaller carriers like SpiceJet.

3. Cargo and freight operations: A limited revenue hedge

Cargo and freight transportation is a critical component of many airlines’ revenue streams, particularly during times of low passenger demand. While SpiceXpress, the airline’s cargo division, provides a diversified income stream, the volume of cargo carried has seen a sharp decline.

- In 2023, the airline transported 39,981.7 tonnes of cargo. It fell to 26,387.4 tonnes in 2024, a 34% drop.

This decline in cargo volume could be attributed to several factors:

Reduced aircraft utilisation: Since a portion of SpiceJet’s fleet is grounded, the available belly space for cargo shipments has decreased.

Intensifying competition: IndiGo and other airlines have scaled up dedicated freight operations, making it harder for SpiceJet to capture market share.

Strategic focus: SpiceJet has historically relied more on passenger traffic than cargo, unlike some global LCCs that have aggressively expanded freight services.

For cargo operations to become a meaningful revenue contributor, SpiceJet would need to invest in expanding its logistics infrastructure and securing more freight partnerships. However, with its current financial priorities, allocating resources to cargo growth may be challenging.

4. Financial constraints and the impact on fleet operations

A low-cost airline thrives on high aircraft utilisation and operational efficiency. However, SpiceJet has been operating at a severe disadvantage due to aircraft lease disputes and financial constraints.

- 40% of its fleet was grounded in recent quarters, severely impacting available seat capacity.

- ASKM declined by over 30% YoY, highlighting the airline’s inability to maintain full operations.

- Debt obligations have limited its ability to secure new aircraft, putting it at a further disadvantage against IndiGo, which has over 1,000 new aircraft on order.

The Rs 3,000 crore QIP and Rs 294 crore promoter funding are expected to help restore some aircraft back to service, but fleet expansion will take time. In the LCC model, fleet efficiency is directly tied to cost structure and profitability, and until SpiceJet can increase aircraft availability, its revenue-generating capacity will remain restricted.

5. Competitive positioning in a consolidating market

The Indian aviation industry is increasingly becoming a two-player market, dominated by IndiGo and Tata Group’s airlines.

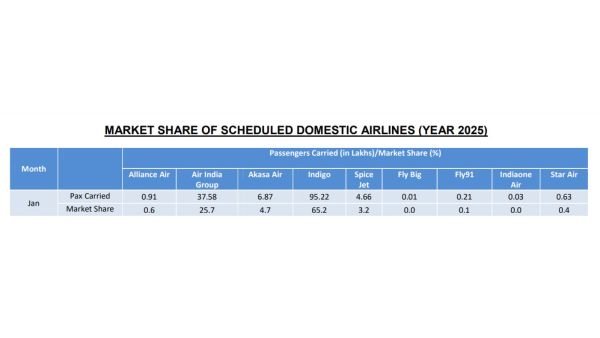

Domestic airlines market share. (Source: DGCA Jan 2025 Report)

Domestic airlines market share. (Source: DGCA Jan 2025 Report)

SpiceJet is now one of the smallest competitors in the domestic aviation market. Its shrinking market share is a direct result of operational instability, limited fleet expansion, and financial stress.

The airline’s ability to compete effectively depends on its ability to execute a recovery plan, focusing on:

- Fleet restoration – Getting grounded planes back into service.

- Cost efficiency – Managing leasing costs and optimising route profitability.

- Market differentiation – Competing with IndiGo’s cost leadership and Tata’s premium full-service offering.

Unlike IndiGo, which benefits from large-scale operations and a dominant cost position, and Tata’s airlines, which provide a premium international alternative, SpiceJet has struggled to define a unique market advantage.

Valuation: A reflection of risk and uncertainty

SpiceJet’s valuation is shaped primarily by its financial health, cost structure, and ability to manage operational expenses. Unlike revenue growth or market share, which reflects business expansion, valuation hinges on profitability, liquidity, and cost efficiency.

For an airline to command a strong valuation, three critical factors matter:

- Profitability and cost efficiency – Lower costs lead to better margins and investor confidence.

- Debt and liquidity management – A strong balance sheet ensures sustainable operations.

- Fleet utilisation and asset productivity – More available aircraft translate into stronger earnings.

Currently, SpiceJet struggles on all three fronts.

1. High Cost per Available Seat Kilometer (CASK) erodes margins

The most critical factor in airline profitability is CASK, which measures how efficiently an airline can manage expenses.

|

Metric

|

SpiceJet (Q3FY25)

|

IndiGo (Q3FY25)

|

|

CASK (total)

|

₹6.50/km

|

₹4.83/km

|

|

Fuel CASK

|

₹1.88/km

|

₹1.58/km

|

|

CASK (ex-fuel)

|

₹4.62/km

|

₹3.25/km

|

Source: SpiceJet and Indigo’s Dec ‘25 Quarterly Report

A higher CASK indicates that SpiceJet’s operating costs are increasing faster than its efficiency improvements. The non-fuel CASK is particularly concerning, as it highlights rising fixed costs such as aircraft leases, maintenance, and airport fees — expenses that remain high even when fewer aircraft are flying.

Meanwhile, IndiGo maintains a lower cost base, allowing it to operate profitably despite industry-wide cost fluctuations.

Why does this matter for valuation?

-

Higher CASK reduces profit margins, making the airline less attractive to investors.

-

Increased fixed costs indicate low flexibility, making cost reduction difficult.

-

If cost inflation continues, SpiceJet may require additional capital infusions, further diluting shareholder value.

2. Fleet utilisation and asset productivity constraints

An airline’s valuation is strongly tied to its ability to maximise aircraft utilisation. More active aircraft mean higher available seat capacity, better revenue potential, and improved cost efficiency.

-

In 2023, SpiceJet’s aircraft flew 93,947 hours domestically.

-

In 2024, this dropped to 67,481 hours, a 28.2% decline in total aircraft hours flown.

-

Similarly, international flight hours declined from 38,572 hours in 2023 to 33,305 in 2024.

Fleet Utilisation Decline: Year-on-Year Comparison

|

Year

|

Domestic Aircraft Hours Flown

|

International Aircraft Hours Flown

|

|

2023

|

93,947

|

38,572

|

|

2024

|

67,481

|

33,305

|

|

Change

|

-28.2%

|

-13.6%

|

Source: DGCA

With fewer aircraft in operation, the airline’s ability to generate revenue per aircraft is constrained. Airlines with high utilisation rates achieve better cost efficiencies and higher returns on fleet investment.

In comparison, IndiGo continues expanding its fleet, ensuring it maintains a high ASKM and spreads fixed costs over more flights.

Why does this matter for valuation?

-

Lower fleet utilisation reduces revenue potential, making valuation multiples weaker.

-

High fixed costs with fewer flights increase cost per seat, leading to uncompetitive pricing.

-

A delay in bringing grounded planes back to service further impacts financial stability.

Until SpiceJet can restore its fleet utilisation, its valuation will remain subdued.

3. SpiceJet’s high EV/EBITDA multiple reflects risk

A company’s EV/EBITDA (Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortisation) ratio is a key measure of valuation, reflecting how the market values the firm relative to its earnings potential.

-

SpiceJet’s EV/EBITDA stands at 10.6x, which is relatively high for a struggling airline.

-

In comparison, IndiGo’s EV/EBITDA is 12.6x, despite its significantly stronger financial position.

While a high EV/EBITDA multiple can indicate growth potential, in SpiceJet’s case, it signals financial stress. Since earnings are negative, the company’s enterprise value is driven primarily by its debt burden and market speculation rather than strong operational fundamentals.

Key Differences in Valuation Metrics (SpiceJet vs. IndiGo)

|

Metric

|

SpiceJet

|

IndiGo

|

Commentary

|

|

EV/EBITDA

|

10.6x

|

12.6x

|

IndiGo’s high multiple is justified by profitability, unlike SpiceJet’s distressed valuation.

|

|

Stock P/E

|

N/A (negative earnings)

|

32.4x

|

SpiceJet has negative earnings, making P/E meaningless.

|

|

Profit Percentage

|

-5.76%

|

10.4%

|

SpiceJet is loss-making, while IndiGo operates at a healthy profit margin.

|

|

ROCE (Return on Capital Employed)

|

1.64%

|

24.5%

|

IndiGo’s returns significantly outpace SpiceJet’s.

|

Source: Tijori Finance and Screener.in

Why does SpiceJet’s EV/EBITDA raise concerns?

-

High EV/EBITDA without earnings growth is a red flag – SpiceJet is valued similarly to profitable airlines despite continuous losses and debt pressure.

-

Limited earnings potential – With a -5.76% profit margin, SpiceJet’s valuation is inflated by debt rather than strong cash flow.

-

Market scepticism – The low market cap relative to industry benchmarks reflects investor caution, indicating that valuation may remain suppressed until operational improvements materialise.

Unless SpiceJet restores profitability and strengthens its balance sheet, its EV/EBITDA ratio will continue to reflect financial risk rather than true growth potential.

A valuation shaped by execution risk

SpiceJet’s current valuation reflects the uncertainty surrounding its financial recovery and operational execution. While the airline has taken steps to address liquidity concerns through capital infusions and cost restructuring, its ability to translate these measures into sustainable profitability remains a key challenge.

The airline operates in an industry where efficiency, cost control, and scale determine long-term viability. Its valuation is shaped by three critical factors:

-

Cost efficiency: CASK indicates ongoing margin pressures. Without cost improvements, profitability remains constrained.

-

Debt and liquidity management: With over Rs 4,500 crore in debt, effective management of repayments, lease obligations, and cash flows will be crucial for stability.

-

Fleet utilisation: A 28% decline in aircraft hours flown year-over-year has reduced revenue generation capacity, making fleet restoration a key driver for operational recovery.

Despite these challenges, SpiceJet continues to operate in a growing aviation market, where increased air travel demand presents opportunities for airlines that can scale efficiently. The company’s valuation, however, remains tied to its execution capabilities — whether it can stabilise operations, optimise costs, and effectively deploy capital to sustain growth.

As the industry consolidates and competition intensifies, SpiceJet’s ability to navigate these complexities will determine how the market perceives its long-term valuation potential.

Note: Throughout this article, we have relied on data from the annual reports and used our assumptions for forecasting.

Parth Parikh has over a decade of experience in finance and research and currently heads the growth and content vertical at Finsire. He has a keen interest in Indian and global stocks and holds an FRM Charter along with an MBA in Finance from Narsee Monjee Institute of Management Studies. Previously, he held research positions at various companies.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities, or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, and resources and only after consulting such independent advisors as may be necessary.

- 01

- 02

- 03

- 04

- 05