Stay updated with the latest - Click here to follow us on Instagram

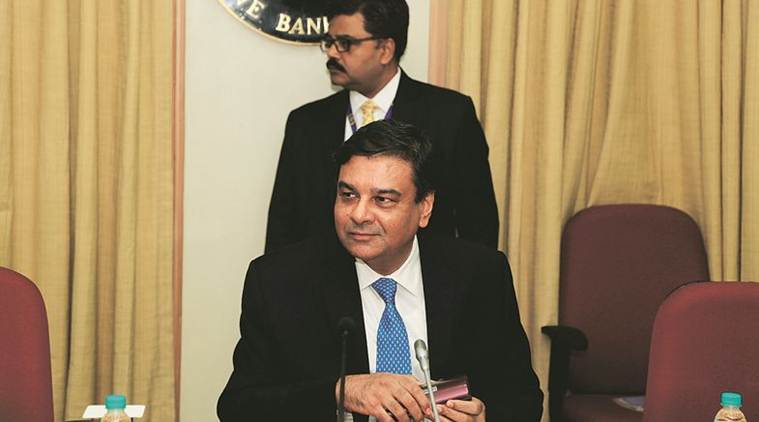

Urjit Patel resigns: From interest rates to demonetisation, here’s how the RBI-Centre rift widened

The RBI and the government had developed differences over several issues.

RBI Governor Urjit Patel stepped down from his post on Monday.

RBI Governor Urjit Patel stepped down from his post on Monday.

Reserve Bank of India (RBI) Governor Urjit Patel on Monday stepped down from his post citing personal reasons. Patel, 55, who took over as the 24th Governor of the central bank on September 5, 2016, had the shortest tenure since 1992.

Patel was hand-picked by the BJP-led government after his predecessor Raghuram Rajan was denied a second term.

The RBI Governor’s resignation came amid tension with the Centre which was brewing for the past several months as both parties increasingly differed on several issues. The rift between the two parties came to the forefront after RBI Deputy Governor Viral Acharya, in a speech in October, stressed the importance of the autonomy of the reserve bank. However, the differences escalated after the last board meeting of the central bank.

The RBI and the government had developed differences over the following issues:

Interest rates: Who controls them?

Trouble between the two parties first broke out after the government expressed dissatisfaction with the bank for not cutting interest rates but raising them. The issue soon turned into who had the authority to change the interest rates. While the Central bank wanted sole authority over raising or lowering the interest rates, the government was unhappy over the bank decisions.

NPA norms

A circular by the bank in February this year on the classification of non-performing assets (NPAs) and norms of loan restructuring served as another trigger to the ongoing rift. A 180-day deadline was set for declaring a loan as an NPA, as per the new guidelines. After 180 days, the stressed account would go to the bankruptcy courts for settlement. The government saw the new regulations as very harsh.

As of now, 11 out of 21 PSU banks are under the RBI watch-list. Dena Bank and Allahabad Bank are also facing restrictions on the expansion of the business.

Nirav Modi scam

The RBI had come under the criticism of the government over the Punjab National Bank fraud of nearly Rs 14,000 crore. The government had accused the bank of failing to supervise banking operations that had resulted in the scam. Hitting back, Urjit Patel had said that the regulator is constrained by inadequate legal powers to supervise and manage public sector banks.

NBFCs

The central bank rejected Centre’s request to provide relief to non-banking finance companies (NBFCs) which are facing a financial crunch after IL&FS defaulted on repayments. One of the largest NBFCs had said that the sector’s request for an audience with RBI top officials was yet to be heard.

Payments regulator

The RBI in October went public with its resistance to the Centre’s proposal to set up an independent Payment Regulatory Board (PRB) which will oversee all payment systems in the country, stating that the proposed body “must remain with the Reserve Bank” and headed by the RBI Governor. Coming out strongly against the Inter-Ministerial Committee’s proposal to take PRB out of the RBI’s purview, the RBI said there has been no evidence of any inefficiency in payment systems of India.

Earlier, the RBI had also opposed the government’s proposal to set up a separate public debt management body and the proposal was kept on hold.

Nachiket Mor removed

The informal removal of Nachiket Mor from the RBI Board, more than two years before his term was to end, irked the top authorities in the bank. Mor had strongly opposed the government’s demand for higher dividends from the bank.

Deputy Governor raises concerns over RBI’s autonomy

RBI Deputy Governor Viral Acharya had raised concerns over the autonomy of the central bank and suggested that undermining independence would have a drastic negative effect on the economy. The Deputy Governor had also made a case of central bank’s autonomy for long-time financial stability in the country.

Demonetisation

Less than four hours before Prime Minister Narendra Modi had announced a ban on Rs 500 and Rs 1,000 notes on November 8, 2016, the central board of the RBI had rejected, in writing, two of the key justifications of the Narendra Modi government — black money and counterfeit notes. The minutes of the meeting, which was signed by the RBI Governor, consisted of six objections which were described as “significant observations” by the team.

Govt wants a third of RBI reserves, central bank says no

The stand-off between the RBI and government widened after the Finance Ministry proposed a transfer of surplus of Rs 3.6 lakh crore, more than a third of the total Rs 9.59 lakh crore reserves of the central bank, to the government. The ministry said that this surplus can be managed jointly by the RBI and the government.

Sources had told The Indian Express that the RBI viewed this attempt by the Government to dip into its reserves can adversely impact macro-economic stability. And therefore, the RBI has not accepted the proposed changes, sources had said. In its opinion, the RBI felt that this did not tantamount to any fresh income, and was essentially in the nature of issuing new securities to fund government expenditure.