Nitin Desai ‘dies by suicide’: How art director defaulted on loan repayments of Rs 252 crore

The NCLT, Mumbai bench in its July 25 judgment ordered 'initiation of Corporate Insolvency Resolution Process' against Nitin Desai’s company ND’s Art World Private Limited.

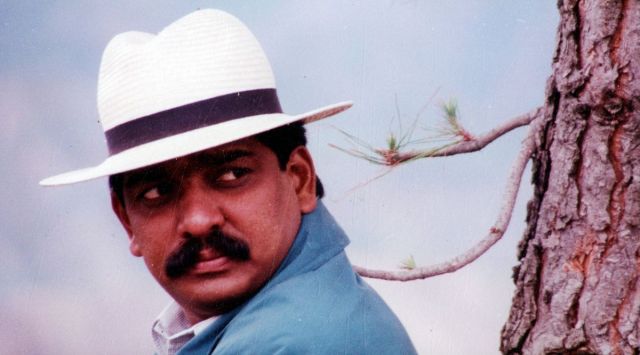

National award-winning art director Nitin Chandrakant Desai, 57, was found dead in a suspected case of suicide over debt burden at his studio in Karjat. (Express archive photo)

National award-winning art director Nitin Chandrakant Desai, 57, was found dead in a suspected case of suicide over debt burden at his studio in Karjat. (Express archive photo) Police sources said that Bollywood art director Nitin Desai, whose body was found at his Karjat studio in Maharashtra’s Raigad district Wednesday morning, may have died by suicide owing to financial constraints.

Notably, the NCLT (National Company Law Tribunal), Mumbai bench in its July 25 judgment ordered “initiation of Corporate Insolvency Resolution Process (CIRP)” against Nitin Desai’s company ND’s Art World Private Limited.

In the said order, the bench also appointed Jitender Kothari as the interim resolution professional to carry out the steps mentioned under the Insolvency & Bankruptcy Code, 2016.

How the debt accumulated

According to the NCLT order, the petition was originally filed by financial creditor CFM Asset Reconstruction Private Limited against corporate debtor ND’s Art World Private Limited for unresolved debt totalling Rs 252.48 crore.

However, the debt was later assigned to M/s Edelweiss Asset Reconstruction Company Limited in 2020.

The order says that ND’s Art World approached ECL Finance Limited (ECLFL) for a loan to the maximum extent of Rs 150 crore and the ECLFL granted a loan of Rs 150 crore in November 2016. It also states that along with the first loan agreement, various security documents securing the loan were also executed by debtors, Nitin Desai, his wife Naina Desai, and KND Investments and Finance Private Limited.

Police officials at Nitin Desai’s ND Art World in Karjat. (Express photo by Narendra Vaskar)

Police officials at Nitin Desai’s ND Art World in Karjat. (Express photo by Narendra Vaskar)

Later in 2018, the company again approached the ECLFL for a loan of Rs 35 crore and while the loan was sanctioned, the corporate debtor availed Rs 31 crore.

The total loan, therefore, aggregated to Rs 181 crore. ND’s Art World was classified as SMA-2 in the books of the ECLFL on March 30, 2020, because of irregular and delayed payments of principal instalments.

Special Mention Accounts (SMAs) are categorised by duration. While an account is categorised as SMA-1 when the overdue period is between 31 and 60 days, the account is classified as SMA-2 when the overdue is between 61 to 90 days.

The defaults

On Jan 31, 2020, the company (ND’s Art World) failed to pay interest amounting to Rs 4.17 crore against the two loans.

On March 31, 2021, the account was declared NPA (non-performing asset) as the company defaulted on the entire outstanding amount.

On March 31, 2022, the company defaulted on the payment of the second loan amounting to Rs 33.24 crore.

On May 9, 2022, the company defaulted on the entire payment of the principal of the first loan amounting to Rs 147.37 crore.

It was further stated that following the defaults by the company, the amount outstanding as on May 15, 2022, (in the case of both loans) aggregated to Rs 247.77 crore and was due and payable immediately. However, no payment was received from ND’s Art World despite this loan recall notice, and as on June 30, 2022, the total default amount stood at Rs 252.48 crore.