Stay updated with the latest - Click here to follow us on Instagram

Mizoram reduces VAT on aviation turbine fuel from 10 to 1 pc

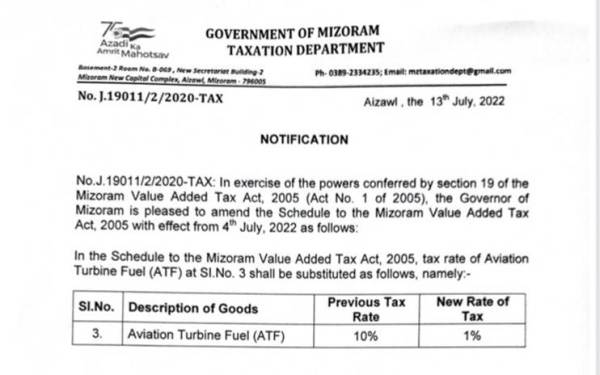

As per the notification shared by Civil Aviation Minister Jyotiraditya Scindia, Mizoram Value Added Tax Act, 2005 has been amended to bring the prices of Aviation Turbine Fuel (ATF) down.

Mizoram reduced VAT on ATF from 10 to 1 pc. (Representational Express Photo)

Mizoram reduced VAT on ATF from 10 to 1 pc. (Representational Express Photo)The Mizoram government has reduced the Value Added Tax (VAT) on jet fuel from 10 to 1 per cent, an official release said.

As per the notification shared by Civil Aviation Minister Jyotiraditya Scindia, Mizoram Value Added Tax Act, 2005 has been amended to bring the prices of Aviation Turbine Fuel (ATF) down.

“In a scenario of rising fuel prices, Mizoram doubles down on our shared efforts to ramp up air connectivity by reducing VAT on Air Turbine Fuel to 1%. I thank CM Sh @ZoramthangaCM Ji for taking the progressive step!,” Scindia has tweeted.

With this, Mizoram joins the league of total 16 States/UTs that have reduced VAT btw 1%-5% in the last one year. Hope the remaining States will also take this decision soon & thus, help us increase flight connectivity for their people.

— Jyotiraditya M. Scindia (@JM_Scindia) July 13, 2022

As per the price list available at various air ticket booking platforms, a flight ticket costs minimum Rs 8,339 for travelling from New Delhi to Aizwal, Rs 7,789 to Agartala and Rs 6,339 to Imphal (Price for August 1). All the three states–Mizoram, Meghalaya and Mizoram, impose 1 per cent VAT on the ATF.

A copy of the notification of ATF pricing issued by the Government of Mizoram. (Photo: Twitter/@JM_Scindia)

A copy of the notification of ATF pricing issued by the Government of Mizoram. (Photo: Twitter/@JM_Scindia)

On August 25 last year, Scindia had urged states and UTs to rationalise VAT on ATF across all airports within the range of 1 per cent to 4 per cent. According to the press realease availble on PIB, the Minister had “asked them to take forward common intention to boost air travel and connectivity in state with a view to accelerate its economic development”.

The price of jet fuel on Thursday was Rs 1,41,232.87 per kilo litre. Last year in October it was around Rs 80,000, almost 40 per cent less, according to data of the state-owned Indian Oil Corporation (IOC).

The prices are inflated in oil-import-dependent India due to higher taxes, costly crude oil following the disruptions in supply chains due to the ongoing Russia-Ukraine war and the weakening of the Rupee against the US dollar, making imports costlier.

India is 85% dependent on imports to meet its oil needs.