Stay updated with the latest - Click here to follow us on Instagram

How to link your Aadhaar card number with your PAN card on Income tax website incometaxindiaefiling.gov.in

How to link your Aadhaar card number with your PAN card: The government had recently made it compulsory to link the Aadhaar with the PAN for filing of Income Tax returns

How to link your Aadhaar with PAN card: The government had recently made it compulsory to link the Aadhaar with the PAN for filing of income tax returns, beginning July 1.

How to link your Aadhaar with PAN card: The government had recently made it compulsory to link the Aadhaar with the PAN for filing of income tax returns, beginning July 1.

How to link your Aadhaar with PAN card: The Income Tax department has launched an e-facility to link an individual’s Aadhaar number with the Permanent Account Number (PAN). The government had recently made it compulsory to link the Aadhaar with the PAN for filing of income tax returns from July 1. However, July 1 is not the last date for linking the two numbers. It is just the day from when the same becomes mandatory. So, your PAN card could be rendered invalid by December this year if you don’t link it by then, but not before July 1.

From July 1, Aadhaar number will have to be mandatorily quoted while applying for PAN, which is a must for filing tax returns, opening of bank accounts and financial transactions beyond a threshold. As many as 2.07 crore taxpayers have already linked their Aadhaar with PAN. There are over 25 crore PAN card holders in the country while Aadhaar has been issued to 115 crore people.

Here is how to link your Aadhaar number with your PAN:

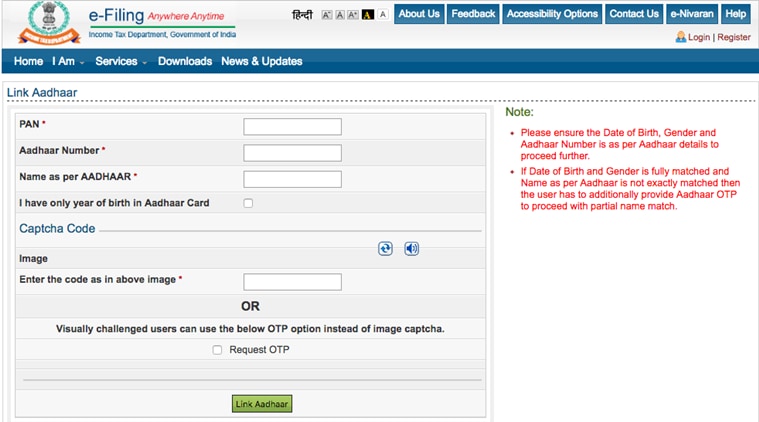

1. The department on its website – https://incometaxindiaefiling.gov.in – has created a new link (“Link Aadhaar”), clicking which would direct the user to the Aadhaar-PAN linking page.

2. The link then requires the user to type his or her PAN number, Aadhaar number and the “exact name as given in the Aadhaar card”. You also have to fill in captcha code, so you’re not identified as a bot.

3. According to the advisory provided by the department on its homepage, the linking will be confirmed following verification from the Unique Identification Authority of India (UIDAI).

4. It also specifies that in case of any “minor mismatch in Aadhaar name provided”, a one time password (OTP) will be required, which will be sent on the registered mobile number and email of the individual. In order to ensure linking without failure, users are urged to make sure that the date of birth and gender in PAN and Aadhaar are exactly the same.

The website also assures that there is no need to login or register on the department’s e-filing website. “This facility can be used by anyone to link their Aadhaar with PAN,” the advisory said.

Under the amendments of the Finance Act 2017, the government made it mandatory for taxpayers to quote the Aadhaar for filing of income tax returns. From July 1 onwards, Aadhar has been made compulsory for applying for PAN as well.