Stay updated with the latest - Click here to follow us on Instagram

Lok Sabha clears Bill for quicker, easier debt recovery

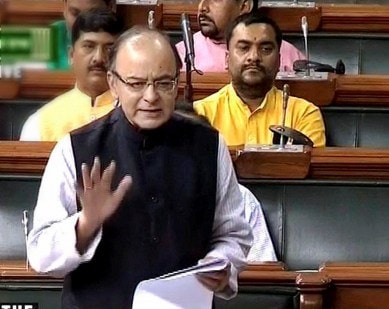

"The present law simplifies the procedure by which there will be quick disposal of pending cases of banks and financial institutions by the debt recovery tribunal," Finance Minister Jaitley said.

The Lok Sabha on Monday passed a law empowering banks to take possession of collateral in the case of loan default, except for farm land, while Finance Minister Arun Jaitley promised a compassionate view on education loans. He ruled out any waiver in the event of education loan defaults, saying “some compassion” has to be shown if someone is unemployed and till he gets a job, but the loan cannot be written off.

The Enforcement of Security Interest and Recovery of Debts Laws and Miscellaneous Provisions (Amendment) Bill, 2016, which was passed by voice vote, seeks to amend four laws — the Sarfaesi Act, the DRT Act, the Indian Stamp Act and the Depositories Act.

monthly limit of free stories.

with an Express account.

The changes in the Sarfaesi Act allow secured creditors to take over a collateral against which a loan had been provided, upon default in repayment. It also provides that the process will have to be completed within 30 days by the district magistrate.

Jaitley said the banks must be empowered to take effective legal action against defaulters, and the insolvency, securitisation and DRT laws are steps in that direction.

“The present law simplifies the procedure by which there will be quick disposal of pending cases of banks and financial institutions by the debt recovery tribunal,” Jaitley said.

Jaitley said farm land has been kept out of the purview of the Act. On concerns expressed with regard to education loans, the minister said “some compassion” has to be shown if someone is unemployed and till he gets a job, but the loan cannot be written off.

Pitching for speedier recovery of debt, he said, “We cannot have a banking system where people take loans and do not repay.”

The Bill, which was introduced in the Lok Sabha in May, aims at faster recovery of debt by PSU banks, which are grappling with Rs 4 lakh crore of NPAs and Rs 8 lakh crore of stressed assets. The Bill was then referred to the Joint Parliamentary committee. The move assumes significance as it comes against the backdrop of the case involving liquor baron Vijay Mallya, who owes Rs 9,000 crore to banks, but has left the country to take refuge in England.